colorado electric vehicle tax rebate

Additionally these vehicles must be certified to federal LEV standards and possess a gross vehicle weight rating of more than 10000 pounds. Discover Incentives and Rebates.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Vehicle Supply Equipment EVSE Rebate - Gunnison County Electric Association GCEA GCEA provides rebates to residential customers toward the purchase of Level 2 EVSE.

. The Colorado Energy Office CEO and Regional Air Quality Council RAQC jointly administer the Charge Ahead Colorado electric vehicle EV charging infrastructure grant program. For additional information consult a dealership or this Legislative Council Staff Issue Brief. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Vehicles purchased from January 1 2023 through January 1 2026 qualify for the following rebates. Compare the cost of your selection to a similar gas vehicle.

Plug-In Electric Vehicle PEV Tax Credit. EV charging stations are being rapidly installed throughout our state and country. There are 84 electric vehicles available nationwide.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in tax credits if. An electric car can save you money. Local and Utility Incentives.

To qualify Xcel customers must be enrolled in specific government. Interstate electric vehicle charging corridor. Although electric vehicles offer many potential environmental advantages over conventional vehicles the tax incentives and charging corridor employed to accelerate electric vehicle adoption likely only serve the two values in limited and narrow circumstances.

Skip the Gas Station. Alternative Fuel Vehicle AFV Tax Credit. State andor local incentives may also apply.

For Colorados 5000 tax credit that means the incentive likely improved sales by 265. There is also a federal tax credit available up to 7500 depending on the cars battery capacity. An electric vehicle state tax credit from the state of colorado for the purchase of an ev and also receive an ev rebate from xcel energy for the same ev customer shall promptly return to xcel energy the difference between the ev rebate and the amount of the state tax credit received for the ev upon notice from xcel energy.

Small neighborhood electric vehicles do not qualify for this credit but they may qualify for another. Why buy an Electric Vehicle. Colorado exempts vehicles vehicle power sources and parts from state tax when used for converting a vehicle power source to reduce emissions.

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan.

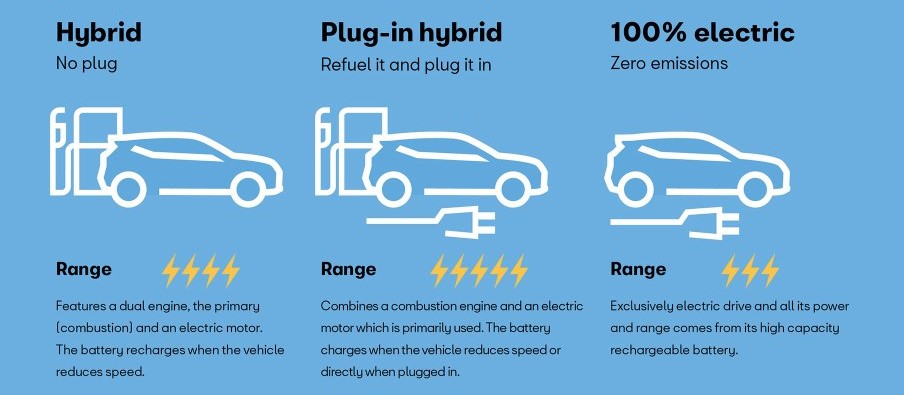

Passenger Motor Vehicle consists of a private electric or plug-in hybrid electric vehicle including vans capable of seating 12 passengers or less eg Chevrolet Volt Nissan Leaf Mercedes-Benz B250e but does not include motorhomes or trucks eg Ford-150. However as of January 1 2017 a few of the rules governing the size and availability of the tax credit have changed. The tax credit for most innovative fuel.

Eligible customers who purchase and install EVSE can receive a. Refer to FYI Income 69 available at TaxColoradogov for more information. Because it can be less expensive to own and maintain than a 100 gasoline-powered car.

As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500. In looking at 400 state and local incentives intended to encourage the adoption of plug-in electric vehicles since 2008 the 2018 NREL study found that for every 1000 of tax credits battery-electric vehicle sales improved 53 while similar rebates increased sales by 77. Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric.

Such a power source includes engine or motor and associated. Electric Vehicles Solar and Energy Storage. In addition to the federal tax incentive of up to 7500 Colorado EV buyers can receive a tax incentive of up to 5000 at the point of purchasing the vehicle and 2500 for leasing an EV.

How much can I save with the Colorado electric vehicle incentive. The credit is worth up to 5000 for passenger vehicles and more for trucks. Trucks are eligible for a higher incentive.

2500 in state tax credits and up to 7500 in federal tax credits. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the. An electric vehicle state tax credit from the state of colorado for the purchase of an ev and also receive an ev rebate from xcel energy for the same ev customer shall promptly return to xcel.

A 5500 rebate on a new electric car and a 3000 rebate on a pre-owned car so long as the price tag does not exceed 50000. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Grants are available for EVs and community-based Level 2 and Level 3 charging stations.

Check em all out and map your route. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles.

Ev Incentives Ev Savings Calculator Pg E

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Colorado Ev Incentives Ev Connect

Ev Tax Credit Calculator Forbes Wheels

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Tax Credit For Electric Vehicle Chargers Enel X

Top States For Electric Vehicles Quotewizard

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Zero Emission Vehicle Tax Credits Colorado Energy Office

All About Electric Vehicles Drive Electric Colorado

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Do Electric Car Tax Credits Work Credit Karma

How Do Electric Car Tax Credits Work Kelley Blue Book

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

Electric Vehicle Tax Credits What You Need To Know Edmunds

Electric Vehicles Charge Ahead In Statehouses Energy News Network